In the world of quantum computing, “Quantum Volume” (QV) is quickly becoming the go-to number that tells us how powerful a quantum computer really is. For traders, this isn’t just technical fluff — it’s a potential preview of the tools that could redefine market analysis, portfolio optimization, and risk modeling. Let’s break it down in human terms and take a look at which platforms are currently leading the pack in 2025.

What Is Quantum Volume, Really?

Think of Quantum Volume like horsepower for quantum computers. It’s not just about how many qubits a machine has — it’s about how good those qubits are, how well they work together, and how deep the system can run circuits before everything falls apart due to errors.

The metric captures:

- Number of qubits (how many “lanes” you have)

- Error rates (how smooth the highway is)

- Gate fidelity (how precise each step is)

- Connectivity (how well lanes link up)

Imagine trying to drive a sports car on a road with potholes. Even if it’s got 800 horsepower, you’re not going anywhere fast. Similarly, a quantum computer with lots of qubits but high error rates isn’t going to solve useful problems. QV measures how big and complex a quantum problem a system can reliably solve — and it scales exponentially. A machine that can handle an 8-qubit circuit 8 layers deep has a QV of 256 (2⁸). Add just one more qubit and layer, and the QV doubles.

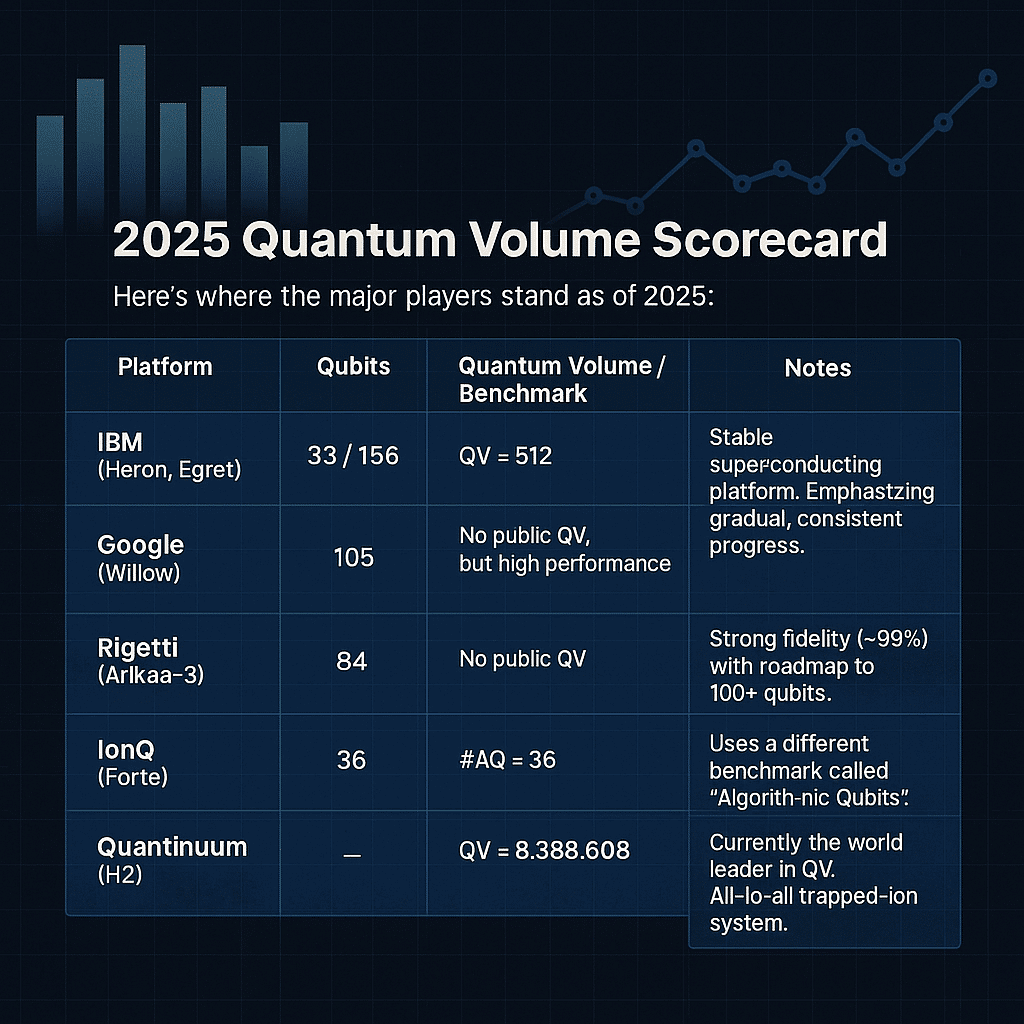

2025 Quantum Volume Scorecard

Here’s where the major players stand as of 2025:

| Platform | Qubits | Quantum Volume / Benchmark | Notes |

|---|---|---|---|

| IBM (Heron, Egret) | 33 / 156 | QV = 512 | Stable superconducting platform. Emphasizing gradual, consistent progress. |

| Google (Willow) | 105 | No public QV, but high performance | Prioritizing error correction and large-scale fault-tolerant architectures. |

| Rigetti (Ankaa-3) | 84 | No public QV | Strong fidelity (~99%) with roadmap to 100+ qubits. |

| IonQ (Forte) | 36 | #AQ = 36 | Uses a different benchmark called “Algorithmic Qubits”. |

| Quantinuum (H2) | – | QV = 8,388,608 | Currently the world leader in QV. All-to-all trapped-ion system. |

The big surprise here? Quantinuum absolutely dominates with a Quantum Volume of over 8 million. That’s orders of magnitude higher than competitors. IonQ is also strong, using a benchmark that reflects usable performance in real-world algorithms.

Superconducting systems like IBM and Google are working toward more scalable architectures. Trapped-ion machines like Quantinuum and IonQ may have fewer qubits but excel in precision and connectivity.

Why Should Traders Care?

Now you might ask, “That’s cool and all, but how does this affect me as a trader?”

Here’s how:

1. Portfolio Optimization

Many trading strategies depend on solving complex optimization problems — like balancing a portfolio to minimize risk and maximize return. Quantum computers are uniquely suited to tackle these kinds of combinatorial challenges using algorithms like QAOA (Quantum Approximate Optimization Algorithm). But you need a high enough QV to handle these problems at scale. The better the quantum computer, the more variables (stocks, assets, constraints) it can juggle without melting down.

2. Risk Modeling and Monte Carlo Simulations

Monte Carlo simulations are used everywhere in finance — from pricing options to modeling tail risk. Classical simulations require thousands to millions of random samples. Quantum versions, however, can reach the same accuracy with fewer samples thanks to algorithms that achieve quadratic speedup. That means faster, cheaper, and potentially more accurate forecasts — especially on high-QV machines.

3. Quantum AI in Trading

Quantum Machine Learning (QML) is still in its infancy, but we’re starting to see quantum-native neural networks and transformers emerge. These could one day make sense of massive, noisy, multi-dimensional market data faster than classical models. Think of using квант AI to detect market anomalies or react to sudden price shifts in real time — but again, this requires reliable and scalable quantum hardware.

4. Random Number Generation and Cryptography

Quantum systems generate randomness naturally. This is great for secure key generation or for producing better-quality random numbers for simulations, which many finance models depend on. A high-QV machine ensures that the randomness isn’t just fast — it’s trustworthy and statistically sound.

Where Is This All Going?

The growth in QV tells us something important — quantum computers are rapidly becoming more capable. Each doubling of Quantum Volume means one more qubit, or one more layer of complexity, can be reliably added to a problem.

What was impossible last year might be feasible this year. That’s why major hedge funds, asset managers, and fintech labs are paying attention. Not because quantum is ready today, but because tomorrow’s edge will go to the firms that start building quantum capabilities now.

Closing Thoughts

Quantum Volume might sound like a lab metric, but for traders, it’s a weather forecast — and the skies are changing fast. As platforms like IBM, Google, and Quantinuum continue to push the QV boundary, expect financial use cases to become less theoretical and more real.

High QV means fewer errors, deeper computations, and more meaningful outputs. In trading terms, it’s the difference between guessing at a pattern and seeing it clearly through the noise.

So if you’re in finance and you haven’t yet tuned into the quantum signal, now’s the time. Because in a few years, those machines humming away in dusty labs might just be building the next-gen trading models your competitors are already testing.