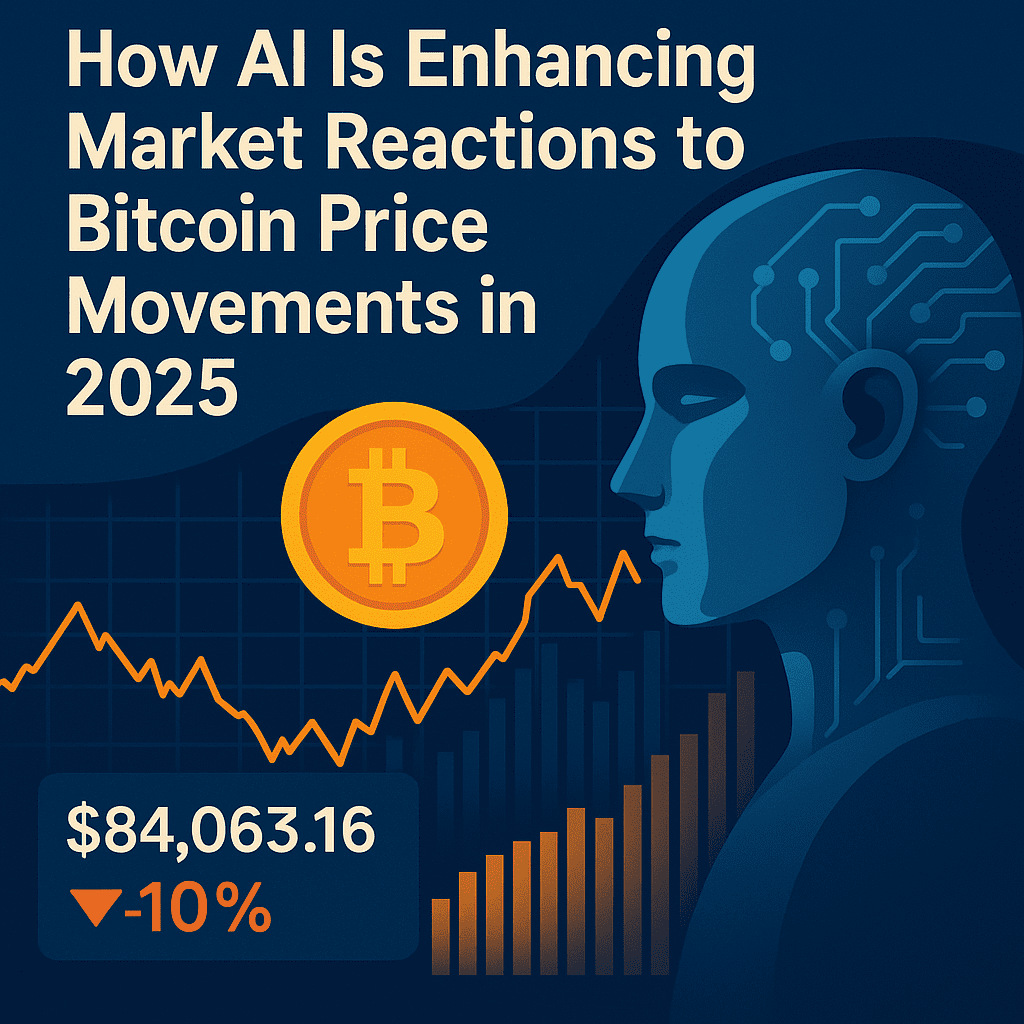

What does it take to have an edge in one of the world’s most turbulent financial landscapes? In the year 2025, the Bitcoin price is still experiencing extreme volatility, with traders looking for increasingly sophisticated, quick mechanisms to help them keep up and as of April 17, Bitcoin is trading at approximately $84,063.16, which is a 10% decline from the high it established earlier in the year.

All of these price changes drive the need for sophisticated real-time decision-making based on multi-level data analysis, where specially engineered AI provides an unmatched advantage. Using AI, traders, analysts and even fintechs are using AI to understand market sentiment and improve modeling, forecasting, risk management and strategic automation.

AI-Powered Sentiment Analysis Is Redefining Market Awareness

Possessing the ability to intercept large amounts of sentiment data enables AI-constrained system sentiments. This came to life in March during a period of blockchain hypergrowth when Bitcoin registered a jump of over $90,000 in a 72-hour timeframe driven solely by the EU’s new regulation to control pseudo-regulated news.

It’s fueled by news indeed; AI-powered obligatory sentiment machines would note changes sharper than within major currencies or USD bolstered across social media, paid-up news parameters and a multitude of other posts spanning more than 2 million sites without regard for business purposes. With enabled AI-driven haste, the traders using said tools were ready to swarm early enough to seize the opportunity.

However, price prediction is not simply a rollercoaster ride. Machine learning is now concerned with predicting what comes next by focusing on the market structure itself.

Improvements in Forecasting Accuracy Comes From Deep Learning

Over the last few quarters, sophisticated models of machine learning have outperformed traditional ones in forecasting the price of Bitcoin. The 2025 University of Zurich Blockchain Center study showed that hybrid LSTM (Long Short-Term Memory) models increased the short-term prediction accuracy by 27% over technical indicators.

These systems analyze a wide range of inputs like macroeconomic factors, orders from exchanges, cycles of news and correlations between different assets. They are able to adjust in real time, learning on the go during turbulent periods, like when inflation data is released or there is speculation on whether an Ethereum ETF will be launched.

AI-backed prediction tools are gaining traction not only in North America and Europe but also in Africa and Asia, where access to algorithm-based approaches through mobile solutions is changing the landscape.

AI is Helping Meet The Standards For Risk Management

In the last 45 days alone, Bitcoin’s price has had three dips over 8%. Controlling this volatility is critical and AI technology is helping traders automate and enhance their risk levels.

The use of AI in dynamic volatility modeling permits rebalancing of the portfolio on the go during significant volatility. A trading firm based in Singapore, for instance, applied an AI position monitoring algorithm and cut drawdowns in Q1 2025 by 18% due to automated exposure trimming during sharp market declines.

AI is advancing “risk heat maps” to better assist traders in foreseeing their likely losses on multiple assets. This enables improved capital allocation and more refined stop-loss methodologies.

Smarter Bots Are Transforming Trade Execution

AI is shifting algorithmic trading from purely reactionary stop and trigger ordering systems towards more nuanced strategies. Today’s trading bots can identify passive market maker spoofing as well as slippage risks and adapt their execution strategy accordingly.

Bots that incorporate AI along with historical depth-of-book data outperformed rule-based bots by 14.5% in profits on mid-cap exchanges, according to a CryptoQuant report published in March 2025.

Such systems will also suspend trading during spikes induced by news, change liquidity targets, or adapt to succeeding floods of trades on winning positions long after the initial boom and even refine execution parameters for predicated market conditions due to feedback from unsuccessful trades.

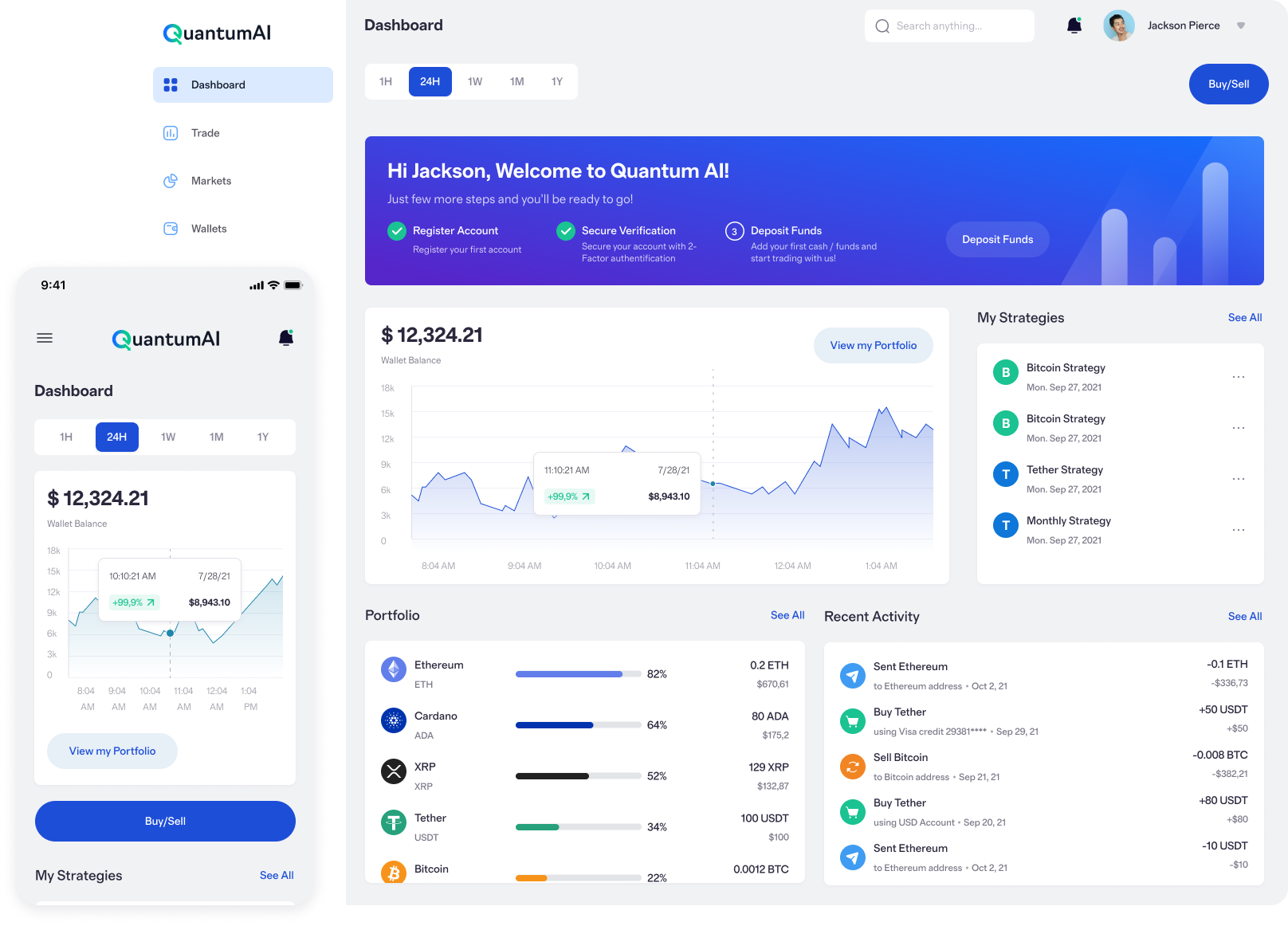

Retail Traders Are Gaining Institutional Tools

AI-driven analytics previously exclusive to hedge funds have, to the delight of retail traders, been integrated into trading platforms. These provide real-time pattern recognition, anomaly detection and news summarization, among other features.

A global survey by FinTech Futures conducted in February 2025 reported that 62% of retail crypto traders now utilize AI for charting, price alerts and strategy assistance. In markets like Southeast Asia and Latin America, mobile-first AI applications are facilitating first-time investor engagement by offering insights unlocking adoption.

The widespread distribution of these tools is providing individuals with resources previously reserved for sophisticated trading desks, signaling a shift toward equity in the financial domain.

Focus on Ethical AI and Market Integrity

As AI technology gets more integrated into trading, there is increased scrutiny regarding market fairness. Regulators are considering the ethical implications of algorithmic trading, especially where AI offers advantages of milliseconds in high-frequency trading.

There are continuous global conversations regarding best practices focused on transparency, the use of data and accountability of the models. As with any powerful tool, responsibility will be essential in determining AI’s long-standing impact on financial markets.

Bottom Line: A New Advantage in Bitcoin Pricing Strategy

AI is giving traders critical leverage as the price of Bitcoin remains highly influenced by global developments. From short-term movement predictions to risk adjusting on the go, artificial intelligence is not just a buzzword but rather the new market advantage.

AI delivers insight, speed and scalability at a level of efficiency modern markets require, while human judgment is still critical throughout the entire process. Every retail trader or institutional desk trader has to adapt to this landscape and AI allows them to see more clearly, respond quicker and work more intelligently.